Motivation for saving money is an essential aspect of financial planning. Saving money requires discipline, patience, and a strong motivation to stick to your goals. Whether you’re saving for a down payment on a house, paying off debt, or building an emergency fund, staying motivated can be challenging. However, the benefits of saving money are numerous, including financial security, freedom, and peace of mind.

There are several ways to stay motivated when it comes to saving money. One approach is to set specific, achievable goals. For example, if you want to save $5,000 in a year, break it down into smaller, more manageable goals, such as saving $100 a week. Celebrating these smaller milestones can help you stay motivated and on track. Additionally, finding an accountability partner, such as a friend or family member, can provide support and encouragement throughout your savings journey.

Why Saving Money Is Important

Saving money is an essential aspect of financial management that everyone should prioritize. It allows individuals to have control over their financial situation, make progress towards their financial goals, and secure their future. Here are some reasons why saving money is important:

1. Achieving Financial Goals

Motivation for saving money is crucial for achieving financial goals. Whether it’s buying a house, starting a business, or saving for retirement, having a savings plan is essential. By setting specific savings goals and milestones, individuals can stay motivated and focused on their financial journey.

2. Building an Emergency Fund

Having an emergency fund is crucial for dealing with unexpected expenses or financial emergencies. It’s recommended that individuals have at least three to six months’ worth of living expenses saved in an emergency fund. This can help reduce stress and financial burden during difficult times.

3. Reducing Debt

Saving money can also help individuals reduce their debt. By creating a budget and setting aside money for debt repayment, individuals can make progress towards paying off their debts and improving their financial situation.

4. Securing the Future

Saving money is critical for securing one’s future. Whether it’s saving for retirement, children’s education, or other long-term goals, having a savings plan in place can help individuals achieve financial security and peace of mind.

5. Improving Financial Literacy

Saving money can also help individuals improve their financial literacy. By understanding how to budget, save, and invest their money, individuals can make informed financial decisions and achieve financial success.

In conclusion, saving money is crucial for achieving financial success and security. By setting specific savings goals, building an emergency fund, reducing debt, and securing the future, individuals can take control of their financial situation and achieve their financial goals.

How to Stay Motivated to Save Money

Saving money can be a challenging task, but staying motivated is even harder. It is easy to get distracted and lose sight of your goals. Here are some tips to help you stay motivated and on track.

1. Visualize Your Goals

One of the most effective ways to stay motivated is to visualize your goals. Create a vision board or a list of things you want to achieve with your savings. This could be anything from buying a house or a car, going on a dream vacation, or paying off debt. Having a clear picture of what you are working towards can help you stay focused and motivated.

2. Track Your Progress

Tracking your progress is an excellent way to stay motivated. Use an app or a spreadsheet to keep track of your savings and expenses. This will help you see how far you have come and how much further you need to go. Seeing progress can be incredibly motivating and can help you stay on track.

3. Celebrate Your Milestones

When you reach a savings milestone, take time to celebrate. This could be something as simple as treating yourself to a favorite meal or buying a small gift. Celebrating your milestones can help you stay motivated and remind you of how far you have come.

4. Find Accountability Partners

Having someone to hold you accountable can be a powerful motivator. Find a friend or family member who is also trying to save money and work together to achieve your goals. You could also join a savings group or find an online community of like-minded individuals. Having someone to share your successes and struggles with can help you stay motivated and on track.

Using a combination of these tips can help you stay motivated and achieve your savings goals. Remember, saving money is a marathon, not a sprint. Stay focused, stay motivated, and you will reach your goals.

Tips for Saving Money

Saving money is a crucial aspect of achieving financial freedom. However, it can be challenging to stay motivated and consistent with saving money. Here are some tips to help you save money and achieve your financial goals.

1. Create a Budget

Creating a budget is the first step to saving money. A budget helps you track your income and expenses, making it easier to identify areas where you can cut back. Start by listing your monthly income and expenses, including rent, utilities, groceries, transportation, and entertainment. You can use budgeting apps or spreadsheets to help you create and track your budget.

2. Reduce Your Expenses

Reducing your expenses is another effective way to save money. Look for ways to cut back on your monthly expenses. For example, you can save money on groceries by buying in bulk, using coupons, and meal planning. You can also save on utilities by turning off lights and unplugging electronics when not in use.

3. Automate Your Savings

Automating your savings is an easy way to save money without thinking about it. Set up automatic transfers from your checking account to your savings account each month. This way, you won’t be tempted to spend the money you intended to save.

4. Invest Your Savings

Investing your savings is an excellent way to grow your money over time. Consider investing in stocks, bonds, or mutual funds. You can also invest in a retirement account, such as a 401(k) or IRA. Investing your savings can help you achieve your long-term financial goals.

5. Pay Off Debt

Paying off debt is another essential step to achieving financial freedom. Make a plan to pay off your debt, starting with high-interest debt first. Consider consolidating your debt or negotiating with creditors to reduce your interest rates.

6. Save for Specific Goals

Saving for specific goals, such as a down payment on a house or a new car, can help you stay motivated and focused on your financial goals. Set specific and achievable goals, and track your progress along the way.

7. Shop Smart

Be a smart shopper by comparing prices, looking for discounts, and using coupons. Consider buying generic brands instead of expensive name brands. Additionally, try to shop during sales and take advantage of loyalty programs to maximize your savings.

8. Reduce Utility Expenses

Cut down on your utility bills by adopting energy-saving habits. Turn off lights and appliances when not in use, use energy-efficient bulbs, adjust your thermostat wisely, and unplug electronics that consume energy on standby. These small changes can add up to significant savings over time.

9. Review Subscriptions and Memberships

Go through your monthly subscriptions and memberships to determine if you’re getting value for your money. Cancel any that you don’t use or no longer need. You might be surprised at how much you can save by eliminating unnecessary recurring expenses.

10. Save on Transportation

Consider alternative transportation methods to save money. Carpooling, using public transport, biking, or walking can not only help reduce fuel and maintenance costs but also contribute to a healthier lifestyle. If you need a car, research and compare prices, choose a fuel-efficient model, and maintain it regularly to avoid costly repairs.

In conclusion, motivation for saving money requires discipline and consistency. By creating a budget, reducing your expenses, automating your savings, shopping smarter, reducing utility expenses, elimination memberships & subscription services, reducing transportation costs, investing your savings, paying off debt, and saving for specific goals, you can achieve your financial goals and enjoy financial freedom.

Conclusion

Saving money is an essential aspect of financial well-being. It provides peace of mind, financial security, and the ability to achieve long-term goals. By following the tips outlined in this article, individuals can stay motivated to save money and achieve financial success.

One effective way to get motivation for saving money is to set achievable goals and track progress. Creating a budget and tracking expenses can help individuals identify areas where they can cut back and save money. Additionally, setting up automatic savings contributions can help ensure that individuals consistently save a portion of their income.

Another way to stay motivated is to celebrate small victories along the way. Whether it’s paying off debt or reaching a savings milestone, taking time to acknowledge progress can help individuals stay motivated and on track.

It’s important to remember that saving money is a long-term process, and it’s okay to make mistakes along the way. The key is to stay committed to the goal and continue making progress, even if it’s slow.

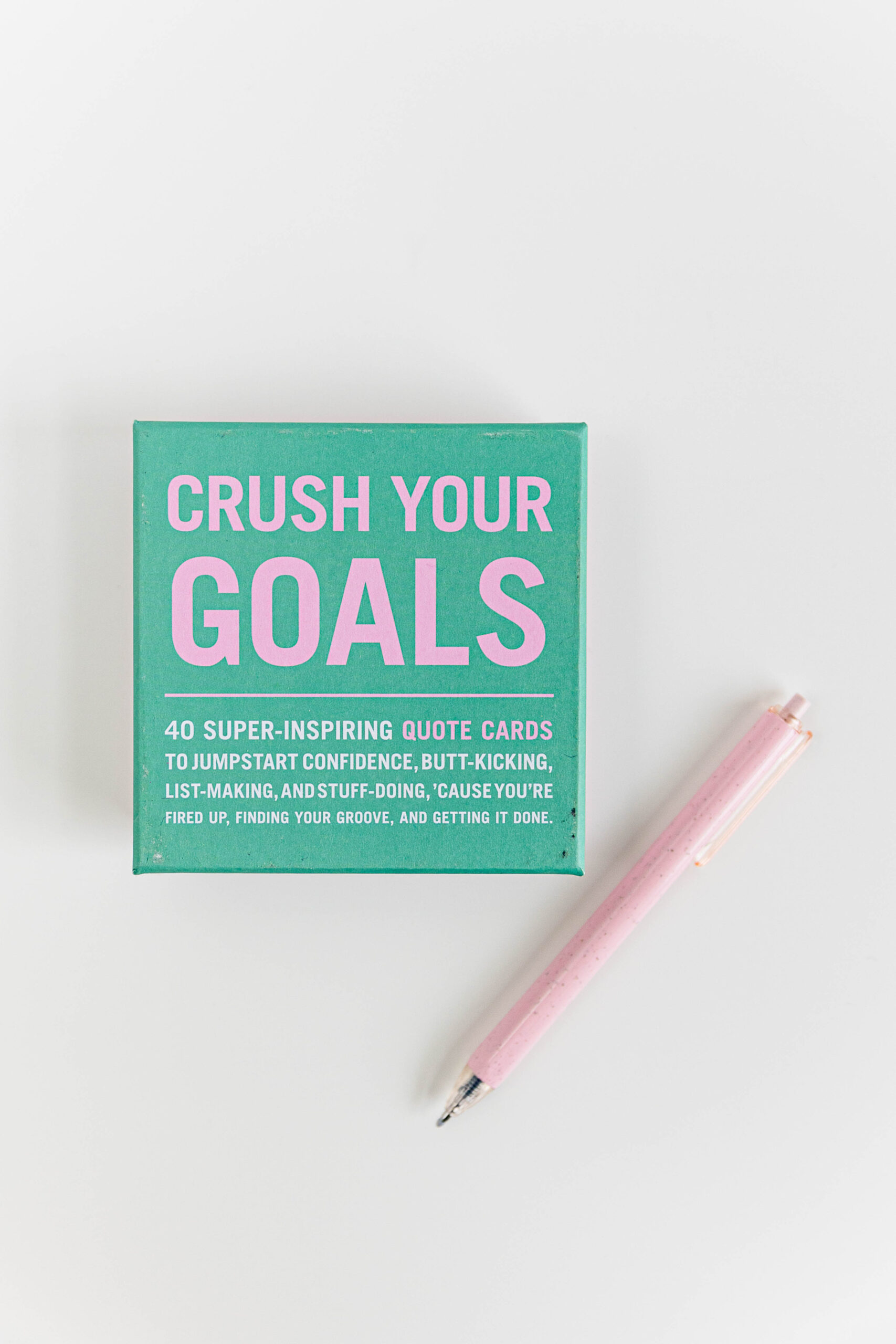

Overall, saving money is an important habit to develop for financial success. By staying motivated and following the tips outlined in this article, individuals can achieve their financial goals and build a secure financial future. If you need some extra motivation,